what does car insurance cover

what does car insurance cover

Contrast quotes from the leading insurance firms. What Is Liability Auto Insurance Policy and also What Does It Cover?

If you are hit by another person, as well as it's their mistake, their obligation insurance coverage will cover damages to your automobile and your clinical bills. There are 2 kinds of obligation insurance coverage: Bodily Injury Obligation, Bodily injury responsibility covers the chauffeur and also occupants of the other vehicle if you trigger an at-fault crash resulting in injuries. vehicle insurance.

Bodily injury obligation covers clinical expenses, discomfort as well as suffering and earnings lost by the other person as a result of not being able to function while recovering from injuries. Residential Property Damages Obligation, Home damages obligation insurance coverage covers damage to the other person's residential property, normally their vehicle, however it can include items inside the vehicle - low cost auto.

The last 50 refers to the quantity of residential or commercial property damage responsibility per accident, which would likewise be $50,000. Maintain in mind that bodily injury liability is per person, while property damage obligation is per mishap. If you struck 3 individuals and three vehicles in the very same crash, your insurance will certainly cover you for approximately $100,000 for the bodily injuries of the individuals you strike ($100,000 maximum) as well as only approximately $50,000 for all three of the cars.

See This Report on Car Insurance - Farm Bureau Financial Services

If you add crash and also detailed insurance coverage to your plan, you as well as your vehicle will be covered in a crash if you're at mistake. This makes the added cost of the insurance policy worth it to the majority of people. Collision will cover damages that occurs from striking something, as well as extensive covers damages from burglary, weather, animals (such as striking a deer) as well as criminal damage.

Some states likewise need uninsured driver coverage (UM), underinsured motorist protection (UIM) and also injury defense (PIP). Despite your state's demands, you need to have liability insurance or really deep pockets, as it's against the law in most states to drive without obligation coverage. New Hampshire doesn't require obligation insurance policy, but they do require chauffeurs to prove they have some ways of economic responsibility if they cause a crash.

Susan would certainly after that get on the hook to pay the extra $22,000 not covered by her obligation insurance coverage. This additionally presumes nobody in the auto Susan strikes sues her for lost incomes or pain as well as suffering. Clinical expenditures add up quickly and can easily bankrupt you. What Is Not Covered by Liability Insurance Policy? Responsibility insurance policy is rather bare bones.

Comprehensive (damage to your own vehicle in anything besides a mishap with one more cars and truck). Uninsured vehicle driver protection (safeguards you if someone without insurance strikes you). Underinsured driver coverage (covers you if you're hit by somebody that does not have enough insurance). Accident defense (points like medical costs and lost salaries).

How Car Insurance - Farm Bureau Financial Services can Save You Time, Stress, and Money.

Below are some of the most frequently asked concerns regarding responsibility insurance policy - cheap insurance. Increase ALLDoes liability insurance policy cover theft?

If you have a funding on the car or rent a vehicle, the finance firm is offering you a funding with the automobile's cost as security. If you just get liability insurance policy and also amount to the cars and truck, it's all of a sudden worth much less than the quantity they loaned you, and also they have no way to recuperate that money - low cost auto.

Does liability insurance coverage cover my vehicle if I'm not at fault? If you're in an accident and also the various other individual is plainly at fault, their obligation insurance coverage ought to cover your auto's damages.

Does responsibility insurance coverage cover my automobile if I am at fault? Liability safeguards any person you struck in a mishap. It does not cover your medical expenditures, damages to your automobile or various other losses you experience. cheap auto insurance. You will not just need to pay for the damage to the various other individual's car, but you will likewise need to pay for the damage to your very own car expense.

Examine This Report on Does Car Insurance Cover A Rental Car? (2022) - Motor1.com

by Valerie Hawkins Chances are, if you possess an auto, as well as you're an obedient resident, you have car insurance policy. And also although vehicle insurance policy is just one of one of the most usual sorts of insurance coverage around there are a great deal of disgusting, confusing terms that accompany it. However do not allow insurance mumbo-jumbo get you overwhelmed.

Often, when you have a lot more concerns than answers on complex insurance policy terms, it may seem easier to do nothing at all. It is feasible to purchase more coverage protection than the minimum level of insurance coverage called for. Responsibility insurance policy protection protects you just if you are liable for an accident and pays for the injuries to others or damages to their residential property. cheap insurance.

The Greatest Guide To Coverages - Auto-owners Insurance

what does car insurance cover

what does car insurance cover

What other sorts of protection can I acquire? Motorists that intend to secure their lorries versus physical damage can need to purchase: This protection is for damage to your automobile resulting from a collision, despite who is at fault. It gives for repair work of the damages to your automobile or a financial payment to compensate you for your loss.

- This spends for dealing with injuries to you as well as your passengers despite mistake. suvs. It also spends for dealing with injuries resulting from being struck as a pedestrian by an automobile. What is a deductible? Your car insurance coverage deductible is the amount of cash you must pay out-of-pocket before your insurance policy compensates you.

You have a Subaru Outback that has Collision Coverage with a $1,000 insurance deductible. You back end an additional vehicle driver, as well as your Subaru is harmed. You take it to the body shop and the complete expense to repair all the damages is $6,500. In this scenario, you would pay the body store $1,000.

Once you have met your $1,000 deductible the insurer will pay the remaining $5,500. Exactly how does my insurance deductible impact the expense of my insurance? Typically, the reduced your insurance deductible, the higher the price of your insurance coverage will be. The greater your deductible is, the reduced the expense of your insurance will be.

Everything about Can Someone Drive My Car And Be Covered On My Insurance?

When buying insurance, the Department of Insurance coverage recommends that you look for the recommendations of a qualified insurance policy professional. There are three types of specialists that generally sell insurance coverage: Independent representatives: can offer insurance from several unaffiliated insurance firms.

No matter what sort of specialist you select to use, it is very important to verify that they are accredited to perform organization in the State of Nevada. You can check the permit of an insurance policy specialist or firm here. Bear in mind Always validate that an insurance policy business or representative are certified prior to providing individual information or payment.

what does car insurance cover

what does car insurance cover

These factors include, but are not limited to: Driving document Claims history Where you live Sex as well as age Marital Standing Make as well as model of your lorry Credit score Nevada has among the most affordable and also healthy and balanced automobile insurance policy markets in the country. Purchasing for insurance might allow you to attain competitive prices (accident).

To find out about using your credit score information by insurance policy firms read our Often Asked Concerns About Credit-Based Insurance Ratings - insure.

Indicators on The Role Of Insurance In A Car Accident Case - Nolo You Should Know

what does car insurance cover

what does car insurance cover

It isn't always required to purchase this insurance coverage, as the majority of conventional car plans expand their coverage restrictions to any type of vehicle driven once in a while. Whether or not you are covered will vary policy to policy The Hanover's Platinum Auto Elite makes certain you're covered. With this function, if you have a crash in a leased vehicle, The Hanover will pay (along with paying for the damage to the rented automobile): Loss-of-use: The rental value of the period the vehicle is out of service for which you are liable Reduced value: The difference in the automobile's resale worth after it has been fixed Reasonable charges: The expenses the rental firm sustains refining the claim for which you are accountable Talk to your independent representative concerning your personal automobile insurance coverage before you rent out a cars and truck, so you can potentially stay clear of unneeded fees.

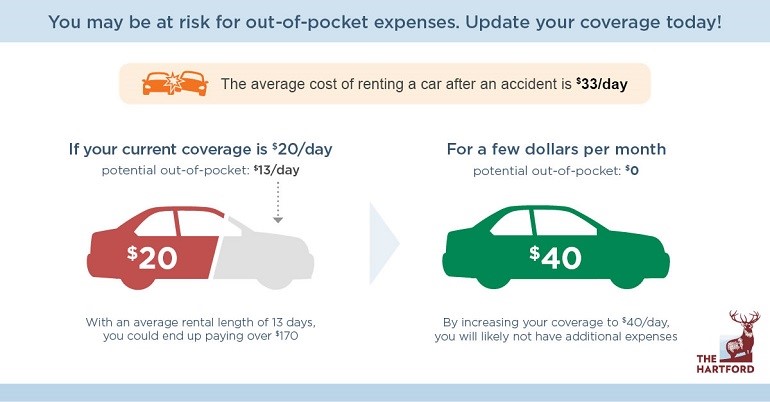

Contact an independent insurance policy agent to aid customize a plan to match your needs. Will my car insurance spend for a rental if my auto remains in the shop? Your vehicle insurance will pay for the price of a rental only if you chose rental reimbursement insurance coverage in your plan.

What's the difference between obligation and full insurance coverage insurance coverage? Obligation insurance coverage automobile insurance insures against the damages you might trigger to other individuals or their home in the occasion of a crash for which you are at fault. Complete protection automobile insurance coverage consists of liability, however also consists of accident and also thorough coverage.

Picking the right insurance is a large choice, and you may have some vital concerns that require responses. Just how do you best protect what is necessary to you? Of all the different types of vehicle insurance, which use the ideal protection for you? Ultimately, it boils down to discovering the most effective method to maintain you, your guests and also others who share the road secure.

The Definitive Guide to Which Types Of Car Insurance Do You Need? - Nerdwallet

A tree dropped on your new car throughout a hefty tornado, and also now it's a wreck. cheapest. You require a tow truck and a leasing, plus your auto needs to be fixed or replaced. Time to call the insurer. Excellent thing you have full protection auto insurance. Or do you? In spite of the appeal of the term, there is no such point as full protection cars and truck insurance coverage.

When you inform your insurance agent you want full insurance coverage, it's simple to assume you have every insurance protection offered. If you want to be fully covered, take into consideration including these: Uninsured and also Underinsured Vehicle Driver Insurance coverage: This coverage pays for your auto fixings when the individual that caused the accident can not pay (car).

When Complete Coverage Does Not Totally Cover You Envision you created an accident, as well as the cars and truck you struck was a deluxe car. Two of the passengers were delivered to the healthcare facility with life-threatening injuries. cheapest car insurance. After the accident, you may discover that you have the right sort of insurance policy, simply inadequate of it.

Auto insurance coverage secures you financially by paying costs that you sustain in a collision, or if your car is harmed or swiped. While your insurance plan is active, your car insurer will spend for damage to your car, your clinical bills and also problems to others that you are accountable for, as long as the occurrence is covered by your policy - cars.

The 15-Second Trick For How Does Car Insurance Work? - Investopedia

The majority of the premium you pay your insurer goes towards Click here for info covering various other individuals's cases, with a smaller sized portion of it covering your insurance company's operating expense. This consists of the cost of adjusting as well as paying insurance claims, as well as establishing costs by evaluating just how most likely its clients are to enter an accident or sue.

What is cars and truck insurance policy? Vehicle insurance policy covers the price of problems when a cars and truck accident occurs.

Physical damages to your automobile or another auto - car. Damages to your residential property or somebody else's residential or commercial property, like a cellular phone or fence. No matter how risk-free and also experienced a chauffeur you are, you can not regulate variables like the weather condition, the state of the roads or the actions of other individuals.

Responsibility vehicle insurance plan integrate two different kinds of coverage: Bodily injury (BI) Building damages (PD) covers any type of costs that emerge from physical injury to the other celebration, varying from funeral prices or lost incomes to medical and also dental costs. covers the expenses of repair work to or substitute of the various other celebration's building harmed in a mishap, whether that is their vehicle, residence or some various other object.

The Main Principles Of Types Of Car Insurance Coverage

Called "split limitations", these numbers represent the optimum amount your insurance provider will certainly pay to cover: Physical problems to a single person. Physical problems to all people included in the mishap. All building damages triggered to others in a mishap. Each state sets. If you drive without insurance coverage that fulfills these minimum limits, you can be subject to penalties and even prison time.

Physical damages cars and truck insurance, by comparison, covers the cost of damage to your auto. There are 2 type of physical damage auto insurance coverage:: spends for damages to your auto if you are at mistake in a crash. If it's vague who is at fault, collision coverage will still pay for your repairs.

This damage might arise from theft, vandalism or natural calamities. In spite of what its name shows, however, extensive automobile insurance policy does not cover every little thing. Individual things taken out of your cars and truck, for example, are not covered. While collision and thorough insurance coverage are both optional, we suggest acquiring them both. If you don't have this coverage, you will certainly be accountable for the full price of repair services to your cars and truck after a crash.

Accident protection and Medication, Pay Individual injury defense (PIP), likewise recognized as "no-fault insurance policy", pays clinical costs for you and also your travelers after a crash. It is usually called no-fault insurance because your insurer pays no matter who is at mistake in a mishap. Some PIP insurance coverage covers lost wages, home and day care expenses, and funeral costs.

Excitement About What Doesn't Car Insurance Cover? - Coverage.com

Another alternative that. Equivalent to PIP, Med, Pay only covers medical and funeral expenses and also normally does not cover lost earnings, psychiatric treatment or rehabilitative care, as PIP does. Uninsured/underinsured vehicle driver coverage If the various other chauffeur is at mistake in a crash, their liability insurance coverage ought to cover your repair work - vehicle.